Research Reports

Raising Auto Insurance Minimums December 2024 Update

December 2024Introduction

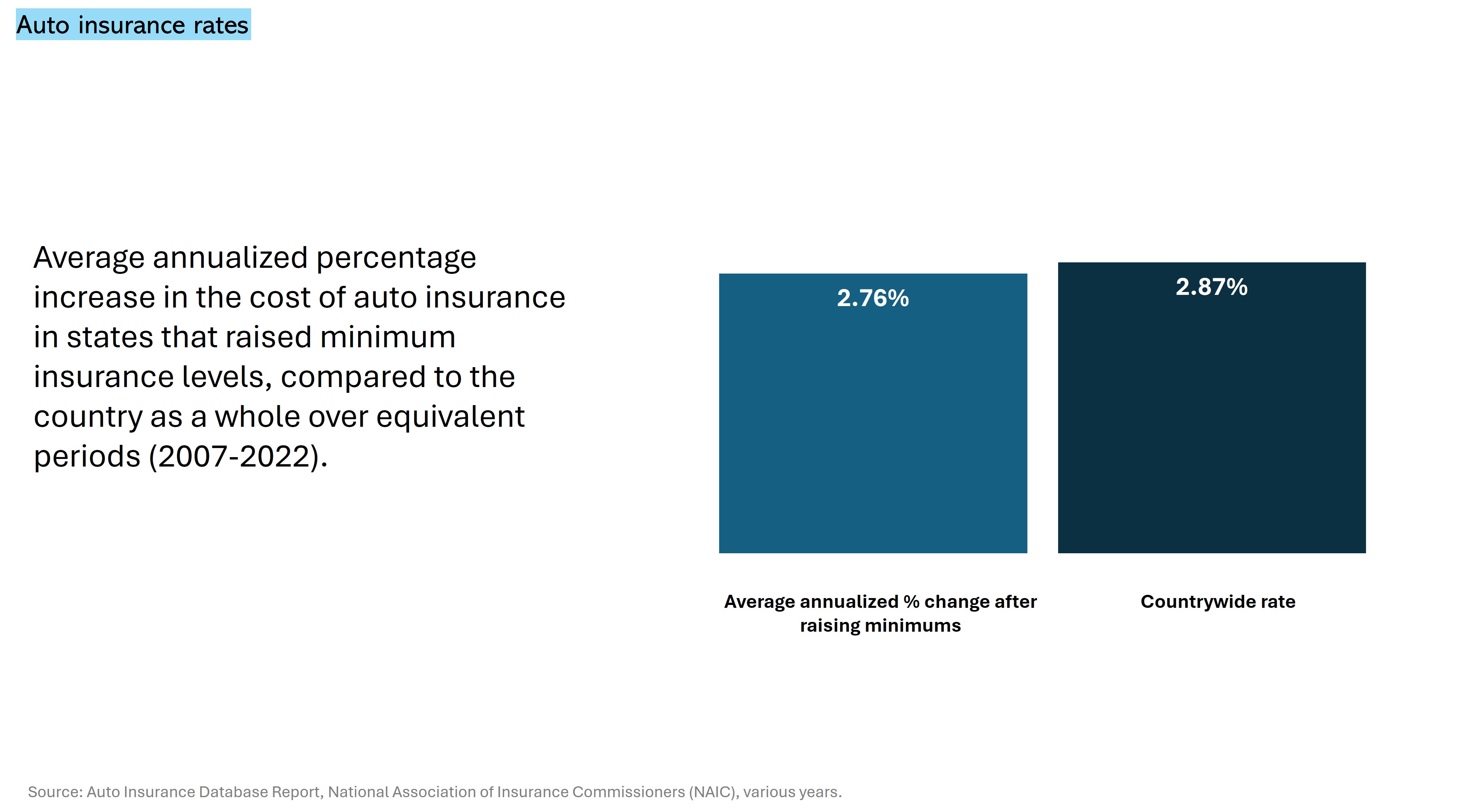

This paper updates the report The Case for Raising Auto Insurance Minimums.1 Updated industry data from the National Association of Insurance Commissioners (NAIC) confirms the conclusion of that report: that the average cost of auto insurance in states that raise their minimum levels of insurance increases at a lower rate than the country as a whole over the equivalent periods.2

[Graph: Auto Insurance Rates Annualized]

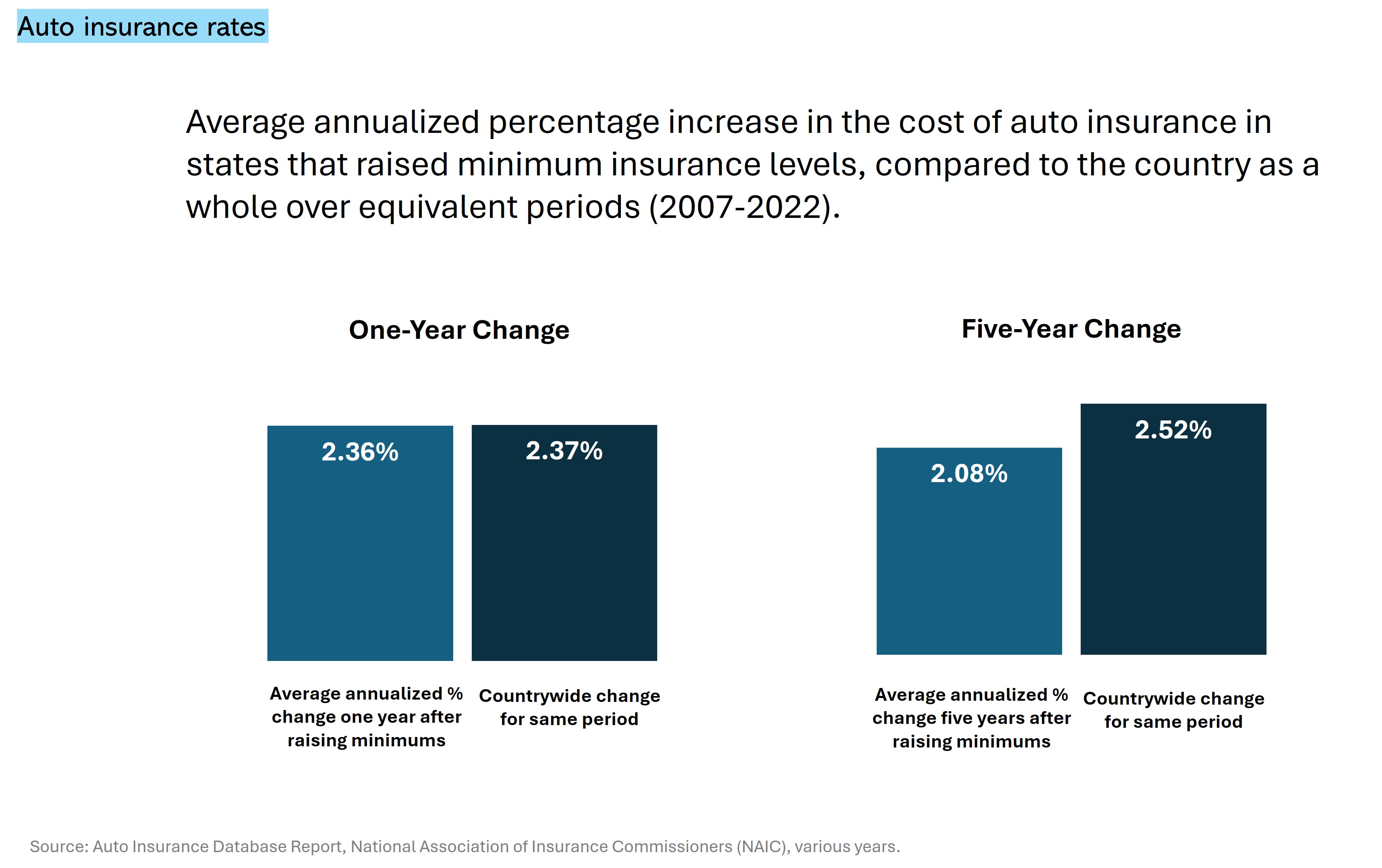

Nor is this a matter of cherry-picking data by, for instance, picking favorable time periods. States that raise insurance minimum levels saw one-year and five-year increases that were below national trends.

[Graph: Auto Insurance Rates - One and Five Year Change]

The Case for Raising Auto Insurance Minimums made clear that there were many reasons to raise required levels of insurance, including:

-

Motor vehicle crash costs exceed $340 billion per year, only half of which is covered by insurance: Over 40,000 people are killed and more than 2 million are injured in motor vehicle crashes each year. The economic cost of these crashes exceeds $340 billion a year, but only 54% of these costs are paid by insurance companies. Crash victims, health care providers, charities, and local governments end up bearing the rest of the economic burden.3

-

Minimum levels of insurance are severely inadequate: Many states set their minimum levels of insurance decades ago and they have not been changed to reflect increases in medical care costs, increases in motor vehicle repair costs, or even inflation generally.

-

Raising minimum insurance requirements does not increase drivers’ premiums: Despite fears that raising required minimum levels of insurance will increase premiums, states that have raised their minimum levels have seen the cost of auto insurance increase at a lower rate than the country as a whole over equivalent periods.

-

Raising minimum levels of insurance does not increase the number of uninsured drivers: Higher minimum insurance levels are associated with lower rates of uninsured motorists. The majority of states that have raised minimums saw the proportion of uninsured drivers decrease.4

-

Increasing minimum insurance levels protects victims: Raising minimum insurance levels helps crash victims who would otherwise be left without full compensation for their losses and relieves the financial burden on health care providers, charities, local governments, and taxpayers.

Conclusion

Raising minimum levels of insurance will better protect crash victims of motor vehicle crashes from being left with hefty bills to pay out of pocket. This simple policy change would bring insurance requirements in line with the real cost of motor vehicle crashes, and thus help to alleviate financial burdens on individuals and families affected by crashes. The perceived downsides to such public policy—increased insurance rates and increased numbers of uninsured drivers—turns out to be more myth than fact.

Methodology

Data on the average auto insurance cost (expenditures) per insured vehicle for the last 15 years (2008-2022) were taken from the NAIC’s Auto Insurance Database Report and Auto Insurance Database Premium Supplement (various editions). The average cost refers to the total written premium for liability, collision, and comprehensive coverages divided by the liability written car-years (exposures). The average cost is an estimate of what consumers in the state spent, on average, for auto insurance. Increases in the cost and premium data for states that raised auto insurance minimum levels during this period were annualized (wherein the inflationary effect is converted into an annual percent change) and then compared to the countrywide data for the same respective periods.

- The Case for Raising Auto Insurance Minimums, American Assn for Justice, June 2024, https://www. justice.org/resources/research/raising-auto-insurance-minimums.

- See Methodology for details on NAIC data used.

- The Economic and Societal Impact of Motor Vehicle Crashes, 2019 (Revised), National Highway Traffic Safety Administration (NHTSA), February 2023, https://crashstats.nhtsa.dot.gov/Api/Public/ViewPublication/813403.

- Factors Associated with Differences in the Incidence of Uninsured Motorists, Milliman, March 11, 2019. Fatality Facts 2021, Insurance Institute for Highway Safety and the Highway Loss Data Institute (IIHS HLDI, May 2023, https://www.iihs.org/topics/fatality-statistics/detail/state-by-state; The Economic and Societal Impact of Motor Vehicle Crashes, 2019 (Revised), National Highway Traffic Safety Administration (NHTSA), February 2023, https:// crashstats.nhtsa.dot.gov/Api/Public/ViewPublication/813403.

About the American Association for Justice (AAJ)

The American Association for Justice works to preserve the constitutional right to trial by jury and to make sure people have a fair chance to receive justice through the legal system when they are injured by the negligence or misconduct of others—even when it means taking on the most powerful corporations.

Copyright © 2024 American Association for Justice®. Reproduction of any kind is prohibited. For more information, please contact AAJ Research at research@justice.org or at (800) 424-2725 or (202) 965-3500, ext. 2811.

Contact AAJ Communications by phone at 202.684.9588 or email media.replies@justice.org. Contact Us